Employees want policies that are Portable. Flexible. Dependable.

International employee benefits encompass a wide spectrum of offerings, of which International Health and Life Insurance play an important part.

International Group Health Insurance can be a crucial lifeline for employees working overseas in locations where medical care is either unavailable, or cripplingly expensive. International Group Life Insurance, on the other hand, offers employees all over the world the comfort of knowing that their loved ones will be financially protected, no matter where they live and work.

For employers who employ staff all around the world, international employee benefit policies not only offer a compelling, compassionate and equitable way to look after employees’ mental, physical and financial wellbeing, but they’re more often than not a powerful talent attraction and retention tool as well.

Talent attraction and retention

According to a recent Gallup Workplace 2024 study, “employees’ long-term commitment to their organisations is currently the lowest it has been in nine years”. This is echoed in PwC’s Global Workforce Hopes and Fears Survey 2024, which asked 56 600 workers across 50 countries how likely they are to change employers within the next 12 months. A resounding 28% answered in the affirmative.

When responding employees were asked what their manager or organisation could have done to prevent them from leaving, 30% listed “provide additional compensation/benefits”.

Obviously benefits encompass a wide range of solutions, and as a recent Forbes Advisor article on employee benefits in 2024 points out, it’s important to ensure that the benefits you offer “are ones that your employees will actually use and appreciate”.

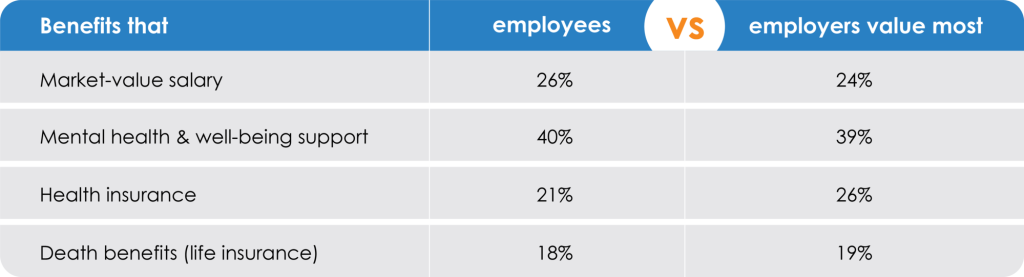

This Ciphr research shows that employers and employees are mostly well-aligned in their thinking about select sought-after benefits:

But this is not necessarily the case when it comes to overall employee financial wellbeing. According to BrightPlan’s 2024 Wellness Barometer, “while 8 out of 10 employers offer or plan to offer financial benefits, 76% of employees are not satisfied with their company’s financial benefits”.

Rising employee financial stress has been well documented, particularly, as BrightPlan highlights, around issues of high inflation/high cost of living (a concern for 95% of respondents), a potential recession (a concern for 88% of respondents) and market volatility (a concern for 87% of respondents).

These concerns are a source of stress for employees all the world around but are arguably more prominently felt by digital nomads and expat employees who may feel more financially vulnerable living and working outside of their countries of residence. And this is where the advantages of international benefits are so keenly felt.

Why invest in international benefits for your teams?

1. International policies offer currency stability

Currency protection is a major benefit of international benefits policies. In the case of Unisure policies, for example, they allow employers to offer their employees policies in GBP, USD or Euros. This is particularly important for multinational companies with employees who aren’t working in First World countries. Should their policies’ currencies fluctuate, they won’t have the peace of mind that their policy will retain its value for their families should they suddenly pass away when the market is at a low.

2. Retention challenges are a global concern and can be costly

Gallup estimates the following costs to replace key staff:

- Leaders and managers – Costs around 200% of their salary

- Professionals in technical roles – Costs around 80% of their salary

- Frontline employees – Costs around 40% of their salary

3. The global cost of lost productivity is staggering

Poor employee wellbeing and burnout costs global employers an estimated $322 billion of turnover and lost productivity, according to Gallup.

Bearing in mind the costs involved in replacing lost employees, it makes financial sense to invest in international benefits for one’s teams, not only because replacing talent can be an expensive exercise, but also because it could profoundly affect employee productivity levels and a company’s bottom line.

If you want to set a new international benefits policy for your company, or upgrade an existing policy, let’s chat. Visit www.unisuregroup.com to learn more about how we can help you and your employees.