Why more people are opting for Dollar, Pound and Euro-based insurance policies

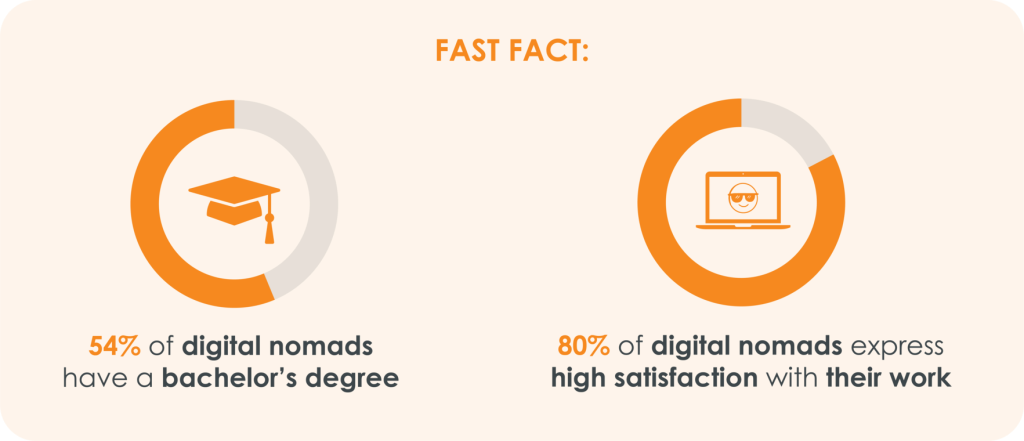

The rise of digital nomadism – the lifestyle of living and travelling around the world while working remotely – indicates a shift towards people prioritising an increasingly ‘fluid’ way of living.

While many digital nomads are tech-savvy youngsters sporting multiple income sources, other groups like families with children and retirees are also embracing the trend. They either want to enjoy a new lifestyle outside of the city or maximise their savings by living in more affordable locations around the world.

And it’s here that Dollar, Pound and Euro-based International Health and Life Insurance policies – like those that Unisure offers to individuals and groups – find their greatest relevance.

The world is becoming increasingly global, as are people’s insurance needs

How insurance products are keeping up with the trends

“There’s a big move towards outsourcing talent and hiring globally, and Unisure is at the forefront of helping employers navigate this trend,” says John Nicholas, actuary and consultant to Unisure. “We’re currently working on a niche offering for European and UK companies, giving multinational companies a unique solution to protect their employees across multiple countries. Offering employers one contract and one single point of contact across multiple countries and currencies has huge time, administration, and cost savings, and we’re confident that interest in a flexible solution like this will only continue to grow.”

In addition to this, Unisure is developing a range of Individual Protection Plans that are portable and based in hard currencies. A digital nomad could purchase a life plan in the UK and move to Vietnam and they would still be covered, without an increase to their premiums. The guaranteed financial protection, no matter where an individual lives or works in the future, is a benefit that many agree is well worth the expense.

Why it pays to take out life insurance sooner rather than later

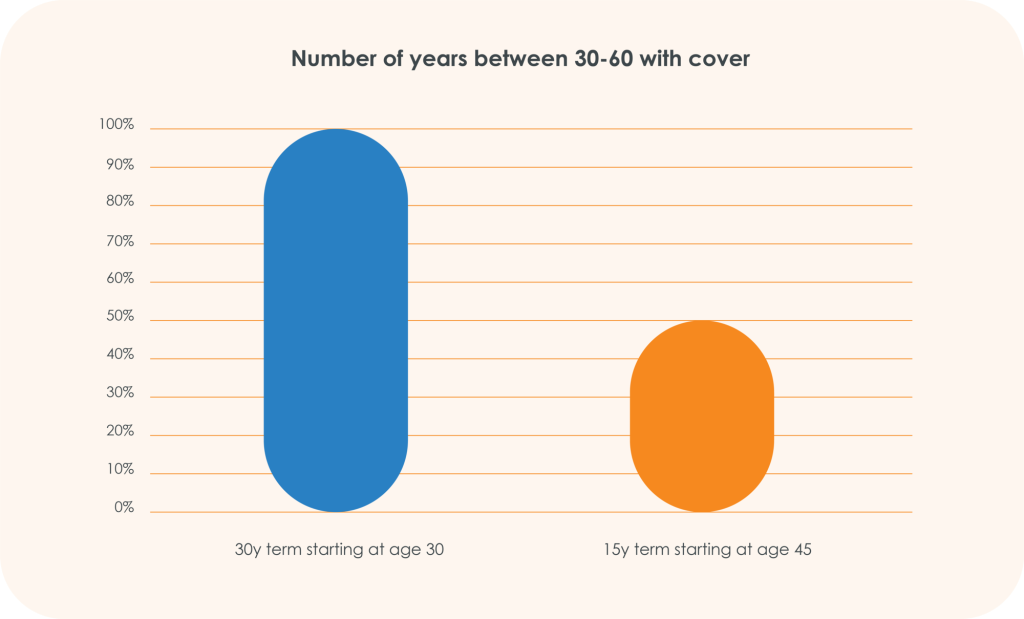

Life insurance (whether we’re talking about a local or international policy) is significantly more cost-effective in the long run when a policy is taken out at a younger age, because the younger you are when you take out a policy, the better able you will be to lock in a favourable, guaranteed rate for a longer period:

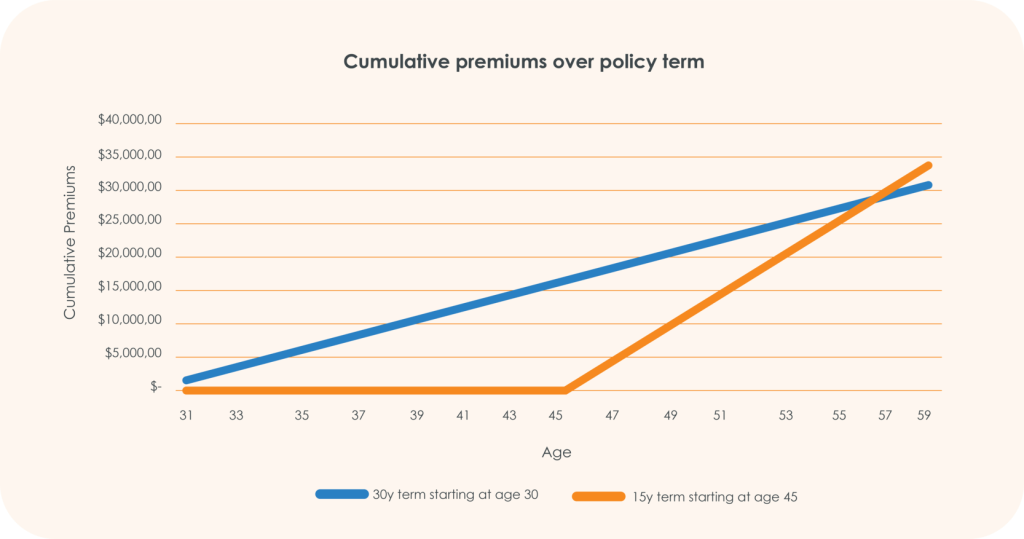

Taking a look at the savings behind buying an insurance policy when you’re younger, this chart shows the cumulative premiums paid by a 30-year-old buying a 30-year life insurance policy versus a 45-year-old buying a 15-year policy:

As you can see from the figures above, the 30-year-old client who bought the 30-year policy only pays USD 30,000 for cover from age 30 to 60. The 45-year-old client, on the other hand, who buys a 15-year term policy will pay USD 33,000+ for cover from age 45 to 60.

“This is quite a significant reduction in value,” John explains. “The older client pays 10% more and they only receive cover for half the period. If anything happens to the policyholder who delayed buying their policy between age 30 to 45, they have no protection.”

This scenario becomes particularly pertinent if either the 30- or 45-year-old doesn’t have a fully portable, international policy and they decide to live or work abroad at any point in their careers.

Should their local policies not cover them outside of their country of residence, it would mean cancelling their existing policies and taking out new (international) policies, likely forfeiting any of the advantages they reaped in taking out a life policy sooner rather than later.

“If you know you’re going to move around for your career, it’s undoubtedly better to take a long-term view to life insurance and take out an international policy when you’re young, rather than buying multiple shorter-term policies and paying up to double the premiums when you change insurers every time you move to a new country,” John confirms.

Clearly, the benefits of international insurance policies in hard currencies are many, and in a world that is increasingly encouraging fluidity, it’s hard to argue beyond the need for global coverage, full portability, and currency flexibility.

For more information on The Unisure Group’s solutions for individuals, families and corporates, visit www.unisuregroup.com.